Why Industrial Occupiers Should Be Moving—Not Waiting

The latest What Occupiers Want 2025 report from Cushman & Wakefield makes one thing clear: industrial occupiers still have leverage—but the clock is ticking.

As someone who works closely with logistics users, manufacturers, and distribution-driven businesses across the West Coast, I’ve seen firsthand how shifting market conditions are reshaping decision-making. This year’s report highlights a critical insight for occupiers:

🔹 Cost is still the #1 driver of portfolio strategy

🔹 Tenant leverage remains—but for how long?

🔹 Those who plan ahead are better positioned to win

What the Data Is Telling Us

According to the Cushman survey of over 235 corporate real estate leaders worldwide:

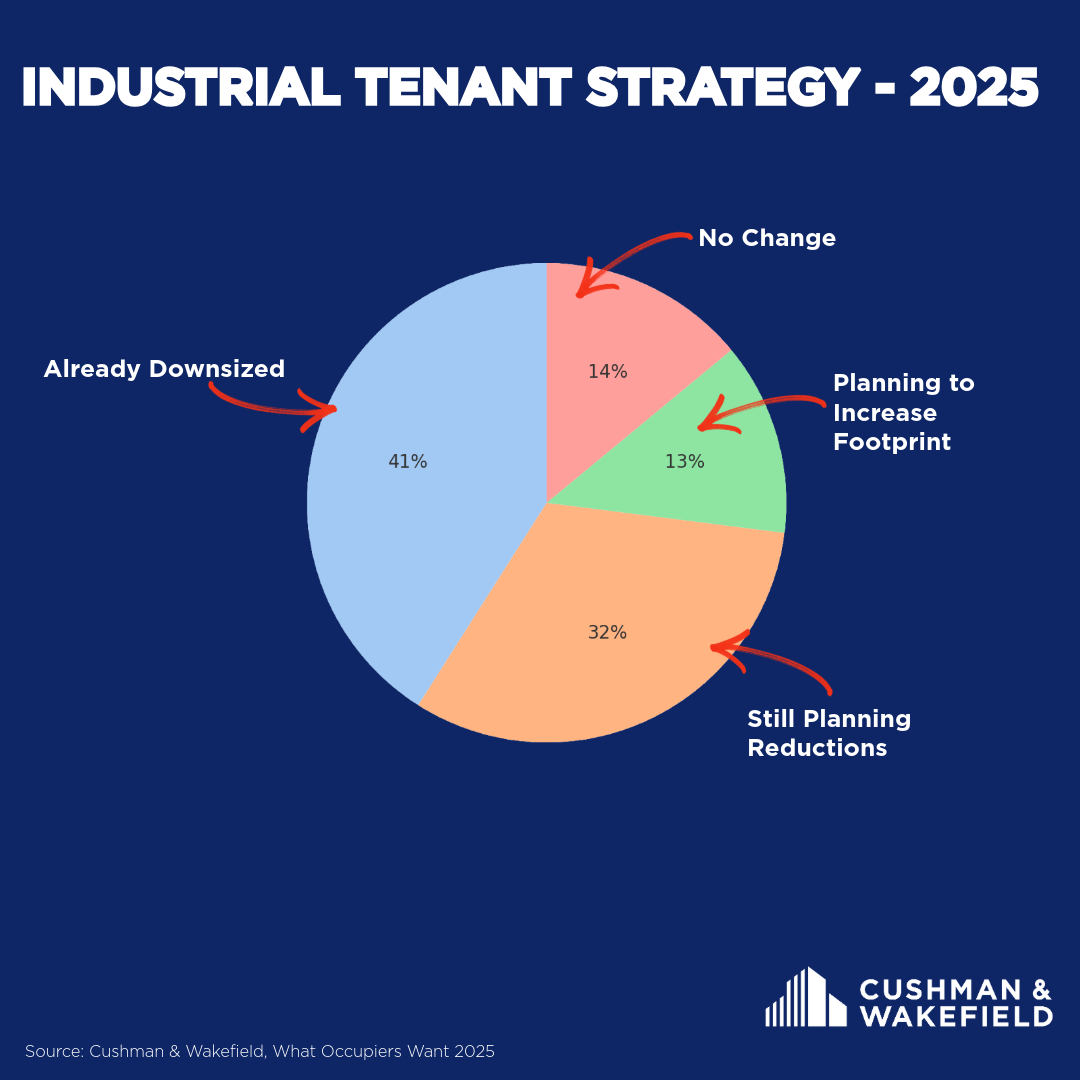

66% of occupiers already reduced their real estate footprint over the last two years

Only 32% plan further reductions, signaling a pivot from reactive downsizing to proactive management

Cost pressure continues to dominate as the primary driver of real estate decisions

In short: the “reset” phase is ending. Industrial tenants that held off on long-term decisions now find themselves in a window of opportunity—but that window is narrowing.

For Industrial Users, Timing Is Everything

On the West Coast, we’re seeing this shift accelerate. A few key trends stand out:

Vacancy rates are stabilizing, especially in core logistics hubs like Reno, Inland Empire, and Northern California

Sublease space is being absorbed more quickly, which may lead to less available space later in the year

Construction pipelines are tightening in certain areas due to cost constraints and permitting delays

Tenants are re-engaging early to lock in favorable terms ahead of potential market rebounds

These dynamics create a unique moment. Industrial occupiers who act now can secure space, mitigate risk, and strengthen their operational foundation—while still holding a degree of negotiating power.

What Occupiers Really Want—And Need

The report also points to a broader shift: occupiers are no longer just looking for “space.” They’re looking for strategic value. This includes:

Sites that align with labor and logistics needs

Flexible footprints to support future automation or growth

Access to transportation corridors for both inbound and outbound flow

Partnerships with landlords who are willing to provide operational support, not just square footage

Industrial real estate is becoming less about the box and more about the ecosystem.

My Advice: Don’t Wait to Be Reactive

Whether your lease is up in 6 months or 2 years, now is the time to evaluate your real estate strategy.

✔️ Are you in the right location to support your supply chain?

✔️ Does your footprint match your growth trajectory or operational needs?

✔️ Are you leveraging the current market dynamics to your advantage?

I work with clients across the West Coast and nationally to evaluate space, unlock leverage, and develop forward-looking real estate strategies rooted in operational performance.

Let’s Talk Strategy Before the Market Shifts Again💡

If you’re an industrial occupier thinking about your next move—or if you just want a clearer view of your options—I’d love to connect.

🔗 Read the full Cushman & Wakefield report here https://www.cushmanwakefield.com/en/insights/what-occupiers-want?utm_source=advocacy&utm_medium=social

📩 Or reach out directly to schedule a strategy session.

The market won’t wait. But the right move now can set you up for long-term success.